In my district, as in many, transportation remains an issue of importance in search of innovative and efficient solutions and funding.

So, why did last year’s proposed one-cent regional sales tax for transportation (TIA) fail in most regions? For some, there is a credibility gap in the “ask” for an additional penny for transportation when we are not spending the penny we already have.

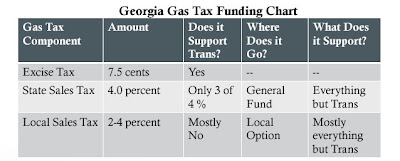

In addition to the Federal Excise Tax of 7.5 cents per gallon of gasoline, Georgia imposes a 4-cent state sales tax (In Gwinnett County an additional 1-cent SPLOST and 1-cent E-SPLOST sales tax brings the total to 6-cents on the dollar). Of the 4-cent state sales tax, the Georgia Department of Transportation (GDOT) reinvests 3-cents into transportation projects. The Georgia General Assembly invests the final 1-cent into other General Fund non-transportation projects. Counties, cities, and school systems invest much of the local sales taxes collected on gasoline into non-transportation projects.

Credit: Baruch Feigenbaum, Transportation Policy Analyst, Reason Foundation

While many of the projects funded with the diverted 1-cent state sales tax on gasoline may be worthy of investment, robbing Peter to pay Paul has rarely proven a successful long-term financing strategy. Sound public policy would suggest investing those funds generated through transportation spending back into transportation system maintenance and improvements a better choice.

Baruch Feigenbaum, Transportation Policy Analyst with the Reason Foundation recently recommended to attendees at a Georgia Public Policy Foundation transportation luncheon that Georgia do just that by reclaiming the fourth cent of state sales taxes collected on gasoline. Mr. Feigenbaum’s presentation is available here.

Although unaware of HB 648, I was pleased to hear Mr. Feigenbaum’s arguments in favor of reclaiming that old penny as I introduced legislation last session (HB 648 co-sponsored by House Transportation Committee Chair Jay Roberts) to begin reinvesting those funds into transportation. HB 648 would return ¼ of a cent each year beginning in fiscal year 2016 through fiscal year 2020 to GDOT. Initially about $40 million a year and once GDOT reclaims the full one-cent approaching $200 million a year in additional transportation dollars.

Can we afford it? I believe so. In my three years as a member of the Georgia House, our state budget has grown from $18.3 to $19.9 billion (remaining well below the pre-recession peak of approximately $23 billion). Recent revenue numbers exceed the Governor’s projections and indications are our state economy is slowly strengthening. Rather than allow new spending to consume revenue growth or battle over cuts to programs currently funded by the diverted penny, allocating a small percentage of returning revenue growth to reclaiming that old penny may go a long way toward improving our mobility, reducing congestion, encouraging business growth, and providing the quality of life all Georgians desire.

Brett Harrell represents the 106th House District in the Georgia General Assembly that includes portions of Grayson, Lawrenceville, Loganville, and Snellville. He is the former Mayor of Snellville and former Executive Director of the Evermore Community Improvement District. Mr. Harrell serves as Vice Chair of the House Budget and Fiscal Affairs Oversight Committee and as a Member of the Regulated Industries, Transportation, and Ways and Means Committees.

No comments:

Post a Comment