I suspected it was only a matter of time and that time is 2013. The weight of the Gwinnett County fees levied against some properties exceed actual property taxes this year. That is right, county property taxes are actually less than the tack-on fees the county assesses against some properties. Of course, one’s wallet and one’s mortgage company cannot tell the difference between a tax and a fee – except that taxes are deductible and fees are not.

Many of you support my effort to remove tack-on fees from our property tax bills (HB 159); the inclusion of fees on our property tax bills is poor public policy period. Economically, the practice tends to hit lower valued properties, perhaps those often at risk of default, the hardest. Non-tax fees consume a higher percentage of the total bill on lower valued properties than high value properties. By increasing monthly mortgage payments via escrow and because of the non-judicial foreclosure statutes in Georgia, including these tack-on fees on property tax bills severely limits a property owner’s ability to stall or avoid foreclosure via negotiations with vendors providing these services.

The result? Freedom is reduced; government grows stronger.

I will continue making the case to remove these add-on fees from your property tax bills. In the meantime, you might support city and county candidates that are willing to do the same.

Friday, November 15, 2013

Thursday, August 29, 2013

An old penny for transportation

In my district, as in many, transportation remains an issue of importance in search of innovative and efficient solutions and funding.

So, why did last year’s proposed one-cent regional sales tax for transportation (TIA) fail in most regions? For some, there is a credibility gap in the “ask” for an additional penny for transportation when we are not spending the penny we already have.

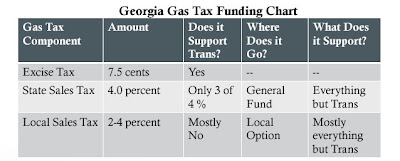

In addition to the Federal Excise Tax of 7.5 cents per gallon of gasoline, Georgia imposes a 4-cent state sales tax (In Gwinnett County an additional 1-cent SPLOST and 1-cent E-SPLOST sales tax brings the total to 6-cents on the dollar). Of the 4-cent state sales tax, the Georgia Department of Transportation (GDOT) reinvests 3-cents into transportation projects. The Georgia General Assembly invests the final 1-cent into other General Fund non-transportation projects. Counties, cities, and school systems invest much of the local sales taxes collected on gasoline into non-transportation projects.

Credit: Baruch Feigenbaum, Transportation Policy Analyst, Reason Foundation

While many of the projects funded with the diverted 1-cent state sales tax on gasoline may be worthy of investment, robbing Peter to pay Paul has rarely proven a successful long-term financing strategy. Sound public policy would suggest investing those funds generated through transportation spending back into transportation system maintenance and improvements a better choice.

Baruch Feigenbaum, Transportation Policy Analyst with the Reason Foundation recently recommended to attendees at a Georgia Public Policy Foundation transportation luncheon that Georgia do just that by reclaiming the fourth cent of state sales taxes collected on gasoline. Mr. Feigenbaum’s presentation is available here.

Although unaware of HB 648, I was pleased to hear Mr. Feigenbaum’s arguments in favor of reclaiming that old penny as I introduced legislation last session (HB 648 co-sponsored by House Transportation Committee Chair Jay Roberts) to begin reinvesting those funds into transportation. HB 648 would return ¼ of a cent each year beginning in fiscal year 2016 through fiscal year 2020 to GDOT. Initially about $40 million a year and once GDOT reclaims the full one-cent approaching $200 million a year in additional transportation dollars.

Can we afford it? I believe so. In my three years as a member of the Georgia House, our state budget has grown from $18.3 to $19.9 billion (remaining well below the pre-recession peak of approximately $23 billion). Recent revenue numbers exceed the Governor’s projections and indications are our state economy is slowly strengthening. Rather than allow new spending to consume revenue growth or battle over cuts to programs currently funded by the diverted penny, allocating a small percentage of returning revenue growth to reclaiming that old penny may go a long way toward improving our mobility, reducing congestion, encouraging business growth, and providing the quality of life all Georgians desire.

Brett Harrell represents the 106th House District in the Georgia General Assembly that includes portions of Grayson, Lawrenceville, Loganville, and Snellville. He is the former Mayor of Snellville and former Executive Director of the Evermore Community Improvement District. Mr. Harrell serves as Vice Chair of the House Budget and Fiscal Affairs Oversight Committee and as a Member of the Regulated Industries, Transportation, and Ways and Means Committees.

Labels:

brett harrell,

city,

gas,

government spending,

GPPF,

Gwinnett,

Reason Foundation,

taxes,

transportation,

U.S. 78

Tuesday, August 6, 2013

It is legal – just un-American

I had another enjoyable opportunity to hear U.S. Congressman

Rob Woodall speak recently at the Snellville Commerce Club lunch (a group of

local business owners – most small businesses). The Congressman suggested our

ire ought not be focused on the National Security Administration (NSA) for “spying”

on Americans, rather, the U.S. Congress and President that enacted the law

making their activities legal. He said the agency reports each year to Congress

their activities and findings so our elected representatives knew or ought to

have known of their actions. Therefore, the activities are legal, but legality does not necessarily mean wise or prudent. The same is true regarding the Patient Protection and Affordable Care (PPAC)

Act or “Obama Care”. It is the law of the land upheld by our highest court. It

is legal; however, many would agree that a government take-over of nearly one

sixth of our economy is anathema to our nation's free enterprise system.

For the past several years, I have been advancing an

argument at the Georgia General Assembly that would prohibit local governments

from billing non-tax fees on your personal ad valorem tax returns. Never have I

suggested the practice was illegal – the Georgia Supreme Court has now

confirmed it is legal; however, I do believe such an assault on one’s private

property in the name of efficient government is unjust.

Recent local news reports several school systems, including

Gwinnett County Public Schools, are installing cameras on school buses to aid in

enforcing traffic laws. In as much as the school systems do not have traffic

enforcement jurisdiction, local governments are necessary partners. Again, the

legality is not in question; however, this is yet another encroachment by

government into our lives at the same time creating a time and money

distraction from the core business of school systems to educate our children.

Yes, it is legal, but should governmental agencies continue the installation of cameras

monitoring our every move?

Perhaps the most egregious to me, local news reports that

Gwinnett County Police have unwillingly strapped one hundred citizens to a

gurney, placed them in a headlock, and forcefully withdrawn their blood based

on a Magistrate’s warrant to aid in securing what is most often a misdemeanor

driving under the influence conviction. Yes, it is legal – just un-American.

Most would agree we must have a safe and secure national

defense and providing a healthcare safety net for our poor and disabled is

without question. Efficient government operations and citizens that pay their

bills is required of all in a civil society. We all desire a safe environment to,

from and during school for our children, and DUI’s are a serious offense. That

said, our nation has grown and prospered in large degree because government has

remained relatively limited in our lives. In my view, each of these seemingly well-intentioned

government intrusions are rapidly moving our nation over the tipping point

where government will dominate our lives and that most certainly is

un-American.

Wednesday, April 10, 2013

2013 Capitol Wrap Up

2013 Session Wrap Up

The 2013 Session of the Georgia General Assembly began late (January 14) and ended early (March 28) – usually indicating good news for taxpayers. The session was largely uneventful, addressing several major items and leaving others for discussion another day. I’ve listed some of the highlights below; please contact me with any questions, concerns, ideas, or suggestions you may have regarding our state.

HB 106 – Fiscal Year 2014 Budget

The FY 2014 budget is balanced at $19.9 billion in state revenues (a 2.8% increase) and $37.1 billion overall. Our investment in education greatly improved this year at 53.4% of state spending or $10.6 billion. HB 106 fully funds Quality Basic Education enrollment growth and Equalization Grants. The pre-K school year is restored to 180 days and Georgia Gwinnett College received the necessary funding to continue its’ strong growth. I voted YES.

The FY 2014 budget is balanced at $19.9 billion in state revenues (a 2.8% increase) and $37.1 billion overall. Our investment in education greatly improved this year at 53.4% of state spending or $10.6 billion. HB 106 fully funds Quality Basic Education enrollment growth and Equalization Grants. The pre-K school year is restored to 180 days and Georgia Gwinnett College received the necessary funding to continue its’ strong growth. I voted YES.

These measures strengthen Georgia’s ethics laws by placing limitations on lobbyist spending, granting rule-making authority to the Ethics Commission, and ease the burden on local officials. The reforms also prohibit providing sporting event tickets or paying for recreational outings and establishes limits on travel expenses. I voted YES.

This bill addresses the abuse of legal pain medications by regulating and licensing pain management clinics. The GBI estimates that since 2010, the number of pain management clinics in Georgia has risen from 10 to 125. Passage of HB 178 requires all pain management clinics register with the Georgia State Board of Pharmacy and be owned by a licensed physician or hospital. I voted YES.

This bill implements many of the recommendations of Governor Deal’s Special Council on Criminal Justice Reform as it relates to juvenile offenders. The bill attempts to improve public safety, outcomes, rehabilitation of non-violent juveniles, and reduce the costs of services. I voted YES.

The HOPE grant program is different from the HOPE scholarship program. The bill lowers the eligibility threshold to 2.0 for HOPE grant recipients and mandates that our Technical College System change from an enrollment-driven formula to an outcome-driven formula in annual budget requests. I voted YES.

This is a comprehensive reform bill aimed at eliminating illegal gambling via coin-operated games often located within convenience stores. In addition to transferring oversight from the Department of Revenue to the Lottery Commission, this legislation also permits players to redeem coupons for lottery tickets – the only game method in Georgia that may legally offer cash payouts. I voted YES.

The “Hospital Medicaid Financing Program Act” often referred to as the “Hospital Bed Tax” authorizes the Department of Community Health to establish a fee on hospitals to utilize to secure additional federal Medicaid funds that are returned to hospitals to offset costs associated with providing Medicaid services. The General Assembly retains the authority to override the DCH Board’s assessment and the bill is automatically repealed on June 30, 2017 unless reauthorized by the General Assembly. I voted YES.

SB 136 lowers the legal limit for Boating Under the Influence to .08 grams – the same as DUI in an automobile. I voted YES.

This bill increases to 200 gallons (matching the federal limit) the amount of home brewed beer one may produce (in any home with two people of legal age), establishes legal transportation methods, and permits home brew beer completions. I voted YES.

Two measures that did not pass that will be considered again next session are:

HB 512 / SB 101 – Safe Carry Protection Act

This bill will greatly expand our personal freedoms for licensed weapons permit holders to carry a firearm of their choosing in more places including bars, churches, and campuses. Private property owners maintain their right to restrict firearms on their property.

This bill will greatly expand our personal freedoms for licensed weapons permit holders to carry a firearm of their choosing in more places including bars, churches, and campuses. Private property owners maintain their right to restrict firearms on their property.

I strongly support passage.

This legislation simply states that taxes and only taxes appear on your property tax bill. Support continues to grow for this strong Constitutional private property measure that will remove non-tax fees from your property tax bill.

I am the author.

Legislation Authored or Co-Sponsored

Should you be interested in the legislation that I have authored or co-sponsored and the current status, you may review those bills here.

As always, I remain appreciative that you allow me to serve as your state Representative. I encourage you to contact me with any comments or questions you have about the legislation being considered at the state Capitol. Now that we are out of session, you can reach me on my cell at 404-966-5804 or via email at brett@voteharrell.com

Thank you,

Brett Harrell

Monday, March 11, 2013

Capitol Update Week 8 - Rise of the Government Lobbyist

Ten days to go in the 2013 Legislative Session

An early release in both the House and Senate on Crossover Day signaled the beginning of the end of the 2013 Legislative Session and the rise of taxpayer funded lobbyists advocating for more government, more bureaucracy, more spending, and less freedom.

HB 512 the Safe Carry Protection Act passed the House and expands both Second Amendment protections and private property rights. Lobbyists for publicly funded schools and universities actively opposed the measure. Upon becoming law, HB 512 would permit, subject to property owner permission, the ability for licensed weapons permit holders to carry on college campuses, bars, and churches.

Taxpayer funded lobbyists and government employees stalled HB 1 Civil Forfeiture Act and HB 159 Property Protection Bill that adhered to Georgia's Constitutional mandate that requires the "Protection to person and property is the paramount duty of government and shall be impartial and complete."

Those same interests prevented HB 176 Mobile Broadband Development Act from coming to the floor and defeated HB 282 Municipal Broadband Investment Act. HB 176 sought to expand mobile broadband coverage and HB 282 would limit government from competing with private industry where the private sector provided coverage.

While I may agree on any given issue with the lobbyists funded by your tax dollars, the prevalence of these interests is much more troubling to me than those private sector advocates that most often simply want government out of our way.

Several bills passing on Crossover Day advance

The following bills remain under consideration and are now in the Senate:

HB 123 the Parent and Teacher Empowerment Act would allow parents to petition their local school board to convert a traditional public school into a public charter school.

HB 127 Automatic Adjustment of Fees requires an automatic adjustment in a fee if it isn't used for the purpose for which it was collected. These fees include the solid waste disposal fee, the tire disposal fee, certain fees pertaining to traffic violations collected by the courts, certain court filing fees, and penalties related to criminal, quasi-criminal, traffic cases, and bond violations.

HB 132 moves the Georgia Board of Pharmacy and Dentistry to the Department of Community Health rather than the Secretary of State's Office.

HB 150 attempts to prevent websites from charging a fee to remove a "mug shot" from publication when the individual in cleared of any crime.

HB 399 clarifies what types of real estate interest are taxable in Georgia via an "ad valorem" tax bill by prohibiting a "possessory interest" tax. Yet another example of local governments use of an "ad valorem" property tax bill for other purposes.

An early release in both the House and Senate on Crossover Day signaled the beginning of the end of the 2013 Legislative Session and the rise of taxpayer funded lobbyists advocating for more government, more bureaucracy, more spending, and less freedom.

HB 512 the Safe Carry Protection Act passed the House and expands both Second Amendment protections and private property rights. Lobbyists for publicly funded schools and universities actively opposed the measure. Upon becoming law, HB 512 would permit, subject to property owner permission, the ability for licensed weapons permit holders to carry on college campuses, bars, and churches.

Taxpayer funded lobbyists and government employees stalled HB 1 Civil Forfeiture Act and HB 159 Property Protection Bill that adhered to Georgia's Constitutional mandate that requires the "Protection to person and property is the paramount duty of government and shall be impartial and complete."

Those same interests prevented HB 176 Mobile Broadband Development Act from coming to the floor and defeated HB 282 Municipal Broadband Investment Act. HB 176 sought to expand mobile broadband coverage and HB 282 would limit government from competing with private industry where the private sector provided coverage.

While I may agree on any given issue with the lobbyists funded by your tax dollars, the prevalence of these interests is much more troubling to me than those private sector advocates that most often simply want government out of our way.

Several bills passing on Crossover Day advance

The following bills remain under consideration and are now in the Senate:

HB 123 the Parent and Teacher Empowerment Act would allow parents to petition their local school board to convert a traditional public school into a public charter school.

HB 127 Automatic Adjustment of Fees requires an automatic adjustment in a fee if it isn't used for the purpose for which it was collected. These fees include the solid waste disposal fee, the tire disposal fee, certain fees pertaining to traffic violations collected by the courts, certain court filing fees, and penalties related to criminal, quasi-criminal, traffic cases, and bond violations.

HB 132 moves the Georgia Board of Pharmacy and Dentistry to the Department of Community Health rather than the Secretary of State's Office.

HB 150 attempts to prevent websites from charging a fee to remove a "mug shot" from publication when the individual in cleared of any crime.

HB 399 clarifies what types of real estate interest are taxable in Georgia via an "ad valorem" tax bill by prohibiting a "possessory interest" tax. Yet another example of local governments use of an "ad valorem" property tax bill for other purposes.

Senator Isakson visits the Capitol

|

U.S. Senator Johnny Isakson and Georgia Representative Brett Harrell

|

As always, I remain appreciative that you allow me to serve as your state Representative. I encourage you to contact me with any comments or questions you have about the legislation being considered at the state Capitol. You can reach me at my Capitol office at 404-656-0254 or on my cell at 404-966-5804 or via email at brett.harrell@house.ga.gov.

Thank you,

Brett Harrell

Labels:

brett,

brett harrell,

brett-harrell,

harrell,

harrell-brett

Sunday, March 3, 2013

Capitol Update Week 7 - Ethics, Beer and Guns

The pace at the Georgia House is

picking up. Crossover Day, the day a bill must pass one chamber to be

considered by the other this session, is Thursday, March 7th. Committees are

meeting more frequently, the number of bills receiving a hearing is growing,

and the Rules Calendar is getting longer.

Last week the House passed two

pieces of Ethics legislation on Monday.

HB 142 relates to

the Georgia Government Transparency and Campaign Finance (Ethics)

Commission and modifies requirements for lobbyists registration and disclosures, regulates

lobbyist spending on Legislators, and restores rule-making authority to

the Commission. HB 142 passed 164-4 and is now in

the Senate.

HB 143 changes

provisions to campaign

contributions and disclosure reports revising both local

official reporting as well as mandating that contributions to

Legislators between January 1 and the first day of the Legislative

Session be reported within five days of the beginning of that Session.

HB 143 passed 167-0 and goes to the

Senate.

The House unanimously passed HB 242 a comprehensive

Juvenile Justice Reform bill.

By the time we reached Friday,

legislation concerned beer.

HB 99 the Home Brewer's

Rights Bill authored by Rep. Jason Spencer passed

easily with a vote of 151-4. I co-signed

this bill that legalizes home-brew competitions, permits the transportation of

home-brewed beer to the competitions, and raises the maximum amount of beer a

person can brew yearly from 50 gallons to 100 gallons (200 gallons if two

people of legal drinking age live in the household).

Next Week

The House is in session on Monday

and Tuesday, we are adjourned Wednesday, and return for Crossover Day on

Thursday. Monday's calendar is published

here. A few bills on interest include:

HB 124 a Sunday Sales

fix providing that a failure to approve package liquor sales on Sunday would

not nullify the prior approval of package beer and wine sales.

HB 125 streamlines the

licensing and citizen verification process dealing with immigration.

HB 361 reiterates that

Georgia is a "right to work" state and provides annual renewal of any

authorization to deduct union dues from employee paychecks.

HB 362 provides that governmental public works contracts shall not be required to use union labor.

HB 159 passes House Ways

& Means Committee

HB 159 my Property Protection Bill passed

the Ways & Means Committee

and is now pending before House Rules. This proposal

that simply says "taxes and only taxes should appear on our property

tax bills" is gaining support. I am pleased that in addition to the

55,000 Georgian's that are members of Americans for Prosperity-Georgia, the

Real Estate Trade Group including the Georgia Association of REALTORS, Mortgage

Bankers Association, Georgia Credit Union League, and Community Bankers

Association among others is actively supporting passage. This week the NFIB,

National Federation of Independent Business added their support. There remains

much work and a long way to go, however, I am gratified that support is

growing. HB 159 is sound public policy and prohibits the use of our property

tax bills as a debt collection tool for tack-on fees.

HB 512

Safe Carry Protection Act hearing Monday afternoon

HB 512 the Safe Carry Protection Act

will be heard before the Public Safety Committee on

Monday afternoon at 3 PM in room 415 of the Coverdell Legislative Office

Building.I strongly support HB 512 and I anticipate it will come to the floor

for a vote quickly.

As always, I remain

appreciative that you allow me to serve as your state Representative. I

encourage you to contact me with any comments or questions you have about the

legislation being considered at the state Capitol. You can reach me at

my Capitol office at 404-656-0254 or on my cell at 404-966-5804 or via

email at brett.harrell@house.ga.gov.

Thank

you,

Saturday, February 16, 2013

Capitol Update Week 5 - Title Fees and the Tennessee River

This week at the Cap

After over six hours in Ways & Means Committee hearings, the House passed HB 80 by Representative Tom Rice modifying the new auto Title Fees that take effect March 1, 2013. The revisions take into account concerns voiced by those in the auto leasing industry as well as those that are avid auto enthusiasts and collectors of older and hobby automobiles. HB 80 passed 159-4 and is now pending in the Senate Finance Committee.

Frequently Asked Questions regarding the new Title Fee and other helpful information is available at the Gwinnett County Tax Commissioner's webpage.

The House also passed HR 4 seeking to resolve the Georgia / Tennessee boundary dispute and allow Georgia access to the Tennessee River for drinking water and other purposes. The Tennessee River generates fifteen times the water flow as the Chattahoochee River and I believe is our only realistic 100-year water solution.

Next Week

The pace of proposed legislation presented on the House floor for a vote will begin to quicken next week. On Tuesday, the House will consider the following bills:

Firearms; carrying and possession of by an administrator within a school safety zone

HB 71

Georgia Municipal Employees Benefit System; total percentage of investments permissible in real estate investments; increase

HB 122

Sexual Offender Registration Review Board; review and utilize records of Board of Pardons and Paroles in making assessments; authorize - I am a co-sponsor.

HB 71

Georgia Municipal Employees Benefit System; total percentage of investments permissible in real estate investments; increase

HB 122

Sexual Offender Registration Review Board; review and utilize records of Board of Pardons and Paroles in making assessments; authorize - I am a co-sponsor.

HB 124

Local elections; votes cast for disapproval of Sunday alcohol sales by retailers shall not nullify prior election results; provide - I am the author.

Local elections; votes cast for disapproval of Sunday alcohol sales by retailers shall not nullify prior election results; provide - I am the author.

HB 160

Mortgages; vacant and foreclosed real property registries; revise provisions

HB 178

Georgia Pain Management Clinic Act; enact

HB 235

Optometrists; revise definition of optometry; remove certain exemption

Mortgages; vacant and foreclosed real property registries; revise provisions

HB 178

Georgia Pain Management Clinic Act; enact

HB 235

Optometrists; revise definition of optometry; remove certain exemption

In Committee

HB 159 my Property Protection Bill will be heard for the first time before the Public Finance and Policy Subcommittee of Ways & Means. For a detailed summary of the bill that would prohibit billing non-tax fees on your property tax bill click here.

Twitter: http://www.twitter.com/brettharrell

Sunday, February 10, 2013

Capitol Update Week 4 - AFY 2013 Budget, Committee Meetings

This week at the Cap

Committee hearings consumed the majority of the week at the Georgia General Assembly. On Friday, the House approved HB 105 the Amended FY 2013 Budget maintaining the overall amount at $19.3 billion. The mid-year budget provides a $172.7 million Education adjustment and reduces revenues by $26.3 million to reflect estimated 3.9% state growth. The AFY 2013 budget passed 145 - 18.

In Committee this week

HB 124 a Sunday Sales

fix that I authored was favorably reported out of the Regulated Industries

Committee as was HB 132 moving the Boards of

Pharmacy and Dentistry to the Department of Community Health rather than the

Secretary of State.

HB 159 my Property

Protection Bill was read for the first time in Ways & Means and assigned to

the Public Finance and Policy Subcommittee. For a detailed summary of the bill

that would prohibit billing non-tax fees on your property tax bill click here.

As always, I remain

appreciative that you allow me to serve as your state Representative. I

encourage you to contact me with any comments or questions you have about the

legislation being considered at the state Capitol. You can reach me

at my Capitol office at 404-656-0254 or on my cell at 404-966-5804 or via

email at brett.harrell@house.ga.gov.

Thank

you again for allowing me to serve as your representative,

Saturday, January 26, 2013

2013 Capitol Update - Week 2 - Budget Hearings, Guns, Vintage Cars

Budget Hearings

This week the House and Senate Appropriation Committees met

in joint hearings for budget presentations from the Governor and leaders of

state agencies. Though once again, the proposed state budget is lean, with

spending at 17% less per capita than a decade ago, and includes cuts to various

programs, the overall budget is proposed to grow approximately 2.6% from $19.3

billion to $19.8 billion in state funds.

Additional funding is included for education – pre-K program

expansion, fully-funding the Quality Basic Education formula, and salary

increases for teachers based on training and experience. The Governor’s

proposal includes $50 million to continue Georgia’s commitment to expanding the

Port of Savannah and $85 million for water and transportation infrastructure

projects.

The Governor’s proposal also includes $246 million in

additional Medicaid funding and a proposal to permit the Department of

Community Health to administer a Hospital Provider Fee to leverage federal

dollars in this program.

The state’s “Rainy Day Fund” or reserve fund is slowly

returning to a more reasonable level and is now $378 million. Georgia maintains

its’ Triple A bond rating and administers state government with 9,000 fewer

employees than five years ago.

I am carefully reviewing the budget document and information

on the various state programs. While I appreciate that the rate of growth has

slowed this year versus last, I remain concerned that certain programs are on a

course that may not be sustainable.

I welcome your input and comments on how Georgia spends and

invests your tax dollars.

Second Amendment /

Gun Rights

I am receiving numerous calls and emails regarding

protecting our liberties with regard to individual gun ownership and one’s

ability to carry the firearm of their choosing. Please be assured I am a strong

supporter of both our U.S. and Georgia Constitutional rights with regard to

firearms. I will support legislation that protects and expands those rights.

Taxing Vintage /

Hobby Vehicles

I am also hearing from you on HB 80 that purports to levy an

ad valorem tax on vintage and hobby vehicles. As one that hopes to be the heir

of a fully restored 1955 Thunderbird, will oppose efforts to increase taxation

on these vehicles.

FB: voteharrell

Twitter: brettharrell

Subscribe to:

Posts (Atom)